Trump Tariffs: The High Price of Global 'Victory'

The $300 Billion Gamble: Is Trump's Trade War Reshaping the World – Or Just Your Wallet?

Imagine a single decree sending shockwaves through the global economy, threatening to dismantle decades of established trade. Four months ago, that’s exactly what happened. Donald Trump stunned the world with a volley of **import tariffs**, sparking widespread **financial panic**. But while many feared immediate economic collapse, the dust has, for now, settled in a surprising way.

The US president claims victory, boasting a handful of new **trade deals** and unilaterally imposing duties on others, seemingly without triggering the massive disruptions predicted. *But is this calm merely the eye of a storm?*

Trump promises a new era for the **US economy**: a surge in federal revenue, a rekindling of **domestic manufacturing**, and hundreds of billions in foreign investment. Yet, the long-term ripple effects, and who ultimately pays the price for this bold repositioning of America’s global economic standing, remain shrouded in doubt. What’s crystal clear, however, is that the gentle shift away from **free trade** has become a **wave crashing across the globe**, fundamentally altering the **international trade landscape**.

And here's why *you* should care: from the price of your smartphone to the stability of your job, these seismic shifts could profoundly impact your everyday life.

The Impossible Deadline: Trump's 90-Day Trade Gauntlet

Rewind to early spring. International policymakers had August 1st ringed on their calendars, not for a holiday, but as a looming deadline. Agree to new **US trade terms** or face potentially ruinous **tariffs**. White House trade adviser Peter Navarro famously predicted "90 deals in 90 days" – a breathless sprint towards a new global order. Trump himself projected an optimistic outlook, but the target always felt like a fantasy.

And it largely was. By late July, only about a dozen deals had been announced. Many were surprisingly thin, barely a page or two long, lacking the intricate provisions typical of past **trade negotiations**. It was less a grand renegotiation and more a frantic patching-up operation under immense pressure.

And here's why *you* should care: from the price of your smartphone to the stability of your job, these seismic shifts could profoundly impact your everyday life.

The Impossible Deadline: Trump's 90-Day Trade Gauntlet

Rewind to early spring. International policymakers had August 1st ringed on their calendars, not for a holiday, but as a looming deadline. Agree to new **US trade terms** or face potentially ruinous **tariffs**. White House trade adviser Peter Navarro famously predicted "90 deals in 90 days" – a breathless sprint towards a new global order. Trump himself projected an optimistic outlook, but the target always felt like a fantasy.

And it largely was. By late July, only about a dozen deals had been announced. Many were surprisingly thin, barely a page or two long, lacking the intricate provisions typical of past **trade negotiations**. It was less a grand renegotiation and more a frantic patching-up operation under immense pressure.

Dodged a Bullet… Or Just Delaying the Inevitable?

The initial 'good news' offered a collective sigh of relief: the most draconian tariffs and dire recession warnings were largely sidestepped. Fears of immediate **economic fallout**, both in the US and abroad, have not materialized. This wrangling, however unsettling, did bring a measure of clarity. Businesses, once paralyzed by uncertainty (a powerful economic weapon in itself), could now resume plans for investment and hiring. Exporters, at least, now largely know the **import duties** their goods face, allowing them to adjust pricing or pass costs onto consumers. This newfound predictability has even eased tensions in **financial markets**, with US shares notably gaining ground.

But don't be fooled by the quiet. The calm comes with a catch. The "typical" tariff for selling goods into the US is now significantly higher than before – exceeding what analysts predicted just six months ago. These aren't the "tariff-busting" agreements of previous decades, designed to dismantle trade barriers. Instead, they represent a *new normal* of increased costs and hurdles.

As Ben May, Director of global macro forecasting at Oxford Economics, soberly warns, these **US tariffs** possess the latent power to "damage" the **global economy**. They are steadily raising prices in the US, squeezing household incomes, and could ultimately reduce demand worldwide as the world’s largest economy imports fewer goods. So, while the immediate catastrophe was avoided, the unseen costs are quietly mounting. *And the question remains: who ultimately bears this burden?*

Dodged a Bullet… Or Just Delaying the Inevitable?

The initial 'good news' offered a collective sigh of relief: the most draconian tariffs and dire recession warnings were largely sidestepped. Fears of immediate **economic fallout**, both in the US and abroad, have not materialized. This wrangling, however unsettling, did bring a measure of clarity. Businesses, once paralyzed by uncertainty (a powerful economic weapon in itself), could now resume plans for investment and hiring. Exporters, at least, now largely know the **import duties** their goods face, allowing them to adjust pricing or pass costs onto consumers. This newfound predictability has even eased tensions in **financial markets**, with US shares notably gaining ground.

But don't be fooled by the quiet. The calm comes with a catch. The "typical" tariff for selling goods into the US is now significantly higher than before – exceeding what analysts predicted just six months ago. These aren't the "tariff-busting" agreements of previous decades, designed to dismantle trade barriers. Instead, they represent a *new normal* of increased costs and hurdles.

As Ben May, Director of global macro forecasting at Oxford Economics, soberly warns, these **US tariffs** possess the latent power to "damage" the **global economy**. They are steadily raising prices in the US, squeezing household incomes, and could ultimately reduce demand worldwide as the world’s largest economy imports fewer goods. So, while the immediate catastrophe was avoided, the unseen costs are quietly mounting. *And the question remains: who ultimately bears this burden?*

Global Shake-Up: Who Wins, Who Loses in the Trade Game?

The impact of Trump’s **trade policy** isn't uniform; it's a patchwork of winners and losers, often determined by the scale of a country’s **trading relationship with the US**.

Take India. While facing potential tariffs exceeding 25% on its exports to the US, economists at Capital Economics suggest the immediate impact on its growth could be minor. Why? US demand accounts for just 2% of India's GDP.

Germany, however, faces a bleaker picture. The 15% tariffs could slice more than half a percentage point off its economic growth this year. Its powerhouse automotive sector, particularly vulnerable, creates a dangerous situation for an economy already teetering on the brink of recession.

Global Shake-Up: Who Wins, Who Loses in the Trade Game?

The impact of Trump’s **trade policy** isn't uniform; it's a patchwork of winners and losers, often determined by the scale of a country’s **trading relationship with the US**.

Take India. While facing potential tariffs exceeding 25% on its exports to the US, economists at Capital Economics suggest the immediate impact on its growth could be minor. Why? US demand accounts for just 2% of India's GDP.

Germany, however, faces a bleaker picture. The 15% tariffs could slice more than half a percentage point off its economic growth this year. Its powerhouse automotive sector, particularly vulnerable, creates a dangerous situation for an economy already teetering on the brink of recession.

Meanwhile, **global supply chains** are visibly shifting. India recently became the top source of smartphones sold in the US, a direct result of fears over **US-China trade relations** prompting giants like Apple to relocate production. Yet, even India must remain vigilant, as nations like Vietnam and the Philippines, with their lower tariffs when selling to the US, could emerge as more attractive suppliers in other sectors.

This global **trade war** has also served as a **wake-up call** for many nations, prompting a scramble to forge new **global alliances**. The UK, for instance, has found added momentum in its pursuit of closer ties with the EU and a **trade deal with India**, eager to diversify beyond a US relationship that now carries an element of jeopardy. *Will these new partnerships fundamentally reshape the global economic order for decades to come?*

The Political Minefield: Can Trump's Gamble Pay Off?

As the details of these deals solidify, the implications for the **US economy** become clearer. Early spring saw a momentary boost in US growth, fueled by a flurry of export sales as businesses rushed to beat impending tariffs. But economists now predict that momentum will dissipate.

Meanwhile, **global supply chains** are visibly shifting. India recently became the top source of smartphones sold in the US, a direct result of fears over **US-China trade relations** prompting giants like Apple to relocate production. Yet, even India must remain vigilant, as nations like Vietnam and the Philippines, with their lower tariffs when selling to the US, could emerge as more attractive suppliers in other sectors.

This global **trade war** has also served as a **wake-up call** for many nations, prompting a scramble to forge new **global alliances**. The UK, for instance, has found added momentum in its pursuit of closer ties with the EU and a **trade deal with India**, eager to diversify beyond a US relationship that now carries an element of jeopardy. *Will these new partnerships fundamentally reshape the global economic order for decades to come?*

The Political Minefield: Can Trump's Gamble Pay Off?

As the details of these deals solidify, the implications for the **US economy** become clearer. Early spring saw a momentary boost in US growth, fueled by a flurry of export sales as businesses rushed to beat impending tariffs. But economists now predict that momentum will dissipate.

One of Trump’s stated goals – boosting government revenue – has seen success. **Import duties** have funnelled over $100 billion into US coffers this year, projected to hit $300 billion annually. That's a jump from roughly 2% to 5% of federal revenue.

But there's a flip side. American shoppers, the ultimate front line, haven't yet felt the full impact of higher prices. However, consumer goods giants like Unilever and Adidas are starting to quantify the increased costs, warning of impending "sticker shock" and price rises. Such a scenario could delay Trump's desired interest rate cuts and potentially dent **consumer spending** – a crucial engine of the US economy.

This presents a very real **political threat** for a president who promised to lower consumer prices, not raise them. The White House has even floated the idea of rebate checks for lower-income Americans – the blue-collar voters who propelled Trump to power. Such a move, requiring congressional approval and potentially unwieldy to implement, is a tacit acknowledgment of the **pocketbook pain** these tariffs could inflict. It’s a politically perilous path for a Republican party facing midterm elections, making the boast of new federal revenue a risky gamble when voters might be paying more at the checkout.

Beyond the Headlines: The Unfinished Business of a Global Trade War

One of Trump’s stated goals – boosting government revenue – has seen success. **Import duties** have funnelled over $100 billion into US coffers this year, projected to hit $300 billion annually. That's a jump from roughly 2% to 5% of federal revenue.

But there's a flip side. American shoppers, the ultimate front line, haven't yet felt the full impact of higher prices. However, consumer goods giants like Unilever and Adidas are starting to quantify the increased costs, warning of impending "sticker shock" and price rises. Such a scenario could delay Trump's desired interest rate cuts and potentially dent **consumer spending** – a crucial engine of the US economy.

This presents a very real **political threat** for a president who promised to lower consumer prices, not raise them. The White House has even floated the idea of rebate checks for lower-income Americans – the blue-collar voters who propelled Trump to power. Such a move, requiring congressional approval and potentially unwieldy to implement, is a tacit acknowledgment of the **pocketbook pain** these tariffs could inflict. It’s a politically perilous path for a Republican party facing midterm elections, making the boast of new federal revenue a risky gamble when voters might be paying more at the checkout.

Beyond the Headlines: The Unfinished Business of a Global Trade War

The saga is far from over. Critical deals remain unhammered, most notably with Canada and Taiwan. Decisions loom for the pharmaceuticals and steel industries. And the colossal issue of China, with its own complex deadlines, remains unresolved. Even existing agreements, many struck verbally, are often unsigned. The "strings attached"—promises of increased purchases of American energy or investment in the US—are often vague, with some foreign leaders even denying the existence of provisions touted by the president.

As Oxford Economics’ Ben May succinctly puts it, the "devil is in the detail" when assessing these tariff agreements, and often, the details are conspicuously light.

While the world may have recoiled from the brink of a ruinous, all-out **trade war**, it now grapples with a complex web of new trade barriers. Trump aims to call the shots, leveraging America's unique position at the center of the **global trading order** it spent decades establishing.

Yet, history suggests that his overarching aim—to return production and **manufacturing jobs** to America—may meet with very limited success. And as the US recalibrates its role, its long-time partners, from Canada to the EU, could start forging new economic and political connections that bypass what they may no longer view as a reliable economic ally.

If these current tariffs trigger a foundational **realignment of global trade**, the ultimate results may not break in favor of the US. These are questions that will unfold not over weeks or months, but over years. In the meantime, Trump’s own voters may still be picking up the tab through higher prices, less choice, and slower **economic growth**. *The true cost of this gamble is only just beginning to reveal itself.*

The saga is far from over. Critical deals remain unhammered, most notably with Canada and Taiwan. Decisions loom for the pharmaceuticals and steel industries. And the colossal issue of China, with its own complex deadlines, remains unresolved. Even existing agreements, many struck verbally, are often unsigned. The "strings attached"—promises of increased purchases of American energy or investment in the US—are often vague, with some foreign leaders even denying the existence of provisions touted by the president.

As Oxford Economics’ Ben May succinctly puts it, the "devil is in the detail" when assessing these tariff agreements, and often, the details are conspicuously light.

While the world may have recoiled from the brink of a ruinous, all-out **trade war**, it now grapples with a complex web of new trade barriers. Trump aims to call the shots, leveraging America's unique position at the center of the **global trading order** it spent decades establishing.

Yet, history suggests that his overarching aim—to return production and **manufacturing jobs** to America—may meet with very limited success. And as the US recalibrates its role, its long-time partners, from Canada to the EU, could start forging new economic and political connections that bypass what they may no longer view as a reliable economic ally.

If these current tariffs trigger a foundational **realignment of global trade**, the ultimate results may not break in favor of the US. These are questions that will unfold not over weeks or months, but over years. In the meantime, Trump’s own voters may still be picking up the tab through higher prices, less choice, and slower **economic growth**. *The true cost of this gamble is only just beginning to reveal itself.*

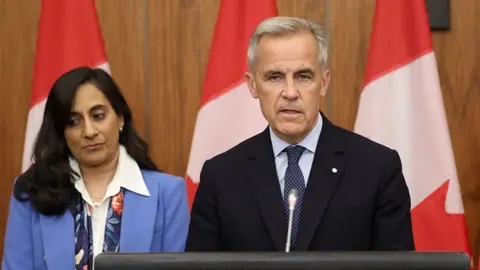

Image 1

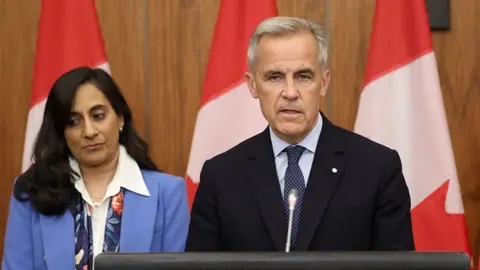

Image 2

Image 3

Image 4

Image 5

Image 6

Comments

Post a Comment